MediPro Blog

The Case for Outsourcing Medical Billing: Streamlining Your Practice for Success

In the dynamic landscape of modern healthcare, medical practitioners are...

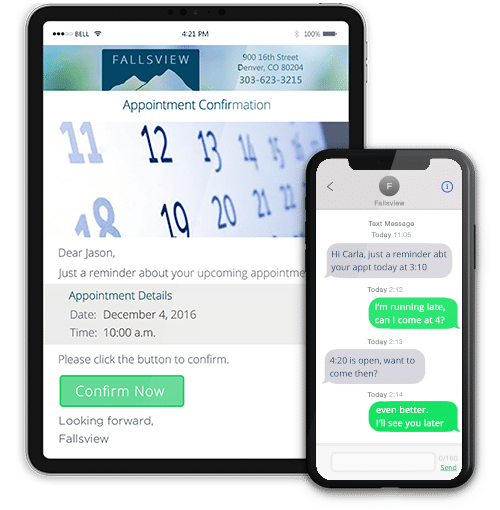

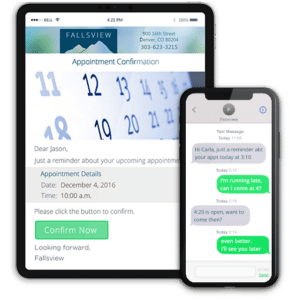

Read MoreEnhancing Patient Care: Why Medical Practices Should Embrace Patient Communicator

In today’s rapidly evolving healthcare landscape, effective communication between medical...

Read MoreEnhancing Patient Engagement

With the healthcare marketplace rapidly changing, it is of the...

Read MoreThe Patient Experience

The Pandemic Push With the emergence of the Covid pandemic,...

Read MoreA Look At Cybersecurity Threats in the Healthcare Industry

A look at cybersecurity threats in healthcare Increased and imminent...

Read MoreStrategies to Improve Patient Collections

According to experts, hospitals, and private practice that do not...

Read MoreTelemedicine and its Role in Revolutionizing Healthcare

Technology has become a centralized component of operation across all...

Read MoreMaintaining Cyber Security in a Small Medical Office

In this article, we would like to discuss an important...

Read MoreBuying EHR Systems – Make Training a Purchasing Factor

How to Assess EHR / EMR Systems Training and Implementation...

Read MoreIn-house vs. Outsourcing Medical Billing

Pros and Cons of Medical Billing Solutions Outsourcing your medical...

Read MoreMedical Billing Services 2019

Medical Billing Services 2019 For smaller medical practices and clinics,...

Read MoreMedical Billing Software 2019

Medical Billing Software Learn about the advantages of using medical...

Read MoreElectronic Health Records Errors – How to Avoid HIPAA Trouble

HIPAA Trouble and EHR Implementation – How to Avoid Legal,...

Read MoreMedical Revenue Cycle Management

Revenue Cycle Management Revenue Cycle Management is a key part...

Read MoreLytec 2020 Upgrade – New Features and More Benefits

Lytec 2020 – The Best Medical Practice Software Lytec© 2020...

Read MoreEHR Medical Software Programs

CureMD Electronic Healthcare Records Software This article provides an overview...

Read MoreEMR Security, Privacy and HIPAA Compliance

Protecting Electronic Medical Records and Medical Practice Liabilities EMR discussions...

Read MoreAdvantages and Disadvantages of EMR vs. Paper-Based Records

Electronic Medical Records vs. Paper-Based Records This article presents the...

Read MorePractice Management Software Features

What Is Practice Management Software? Medical practice management software (PMS)...

Read More